Corporate Governance

Basic Corporate Governance Policy

We aim to fulfill our social responsibilities as a good

corporate citizen so that we can gain and retain the respect

from stakeholders and be recognized as a valuable enterprise. We

work to establish a high degree of transparency in management

systems to ensure full legal and regulatory compliance and

respect for social norms.

In addition, to coexist with the Earth and society and to

develop sustainably, we have established the Sustainability

Promotion Committee and promoted management initiatives with a

focus on sustainability.

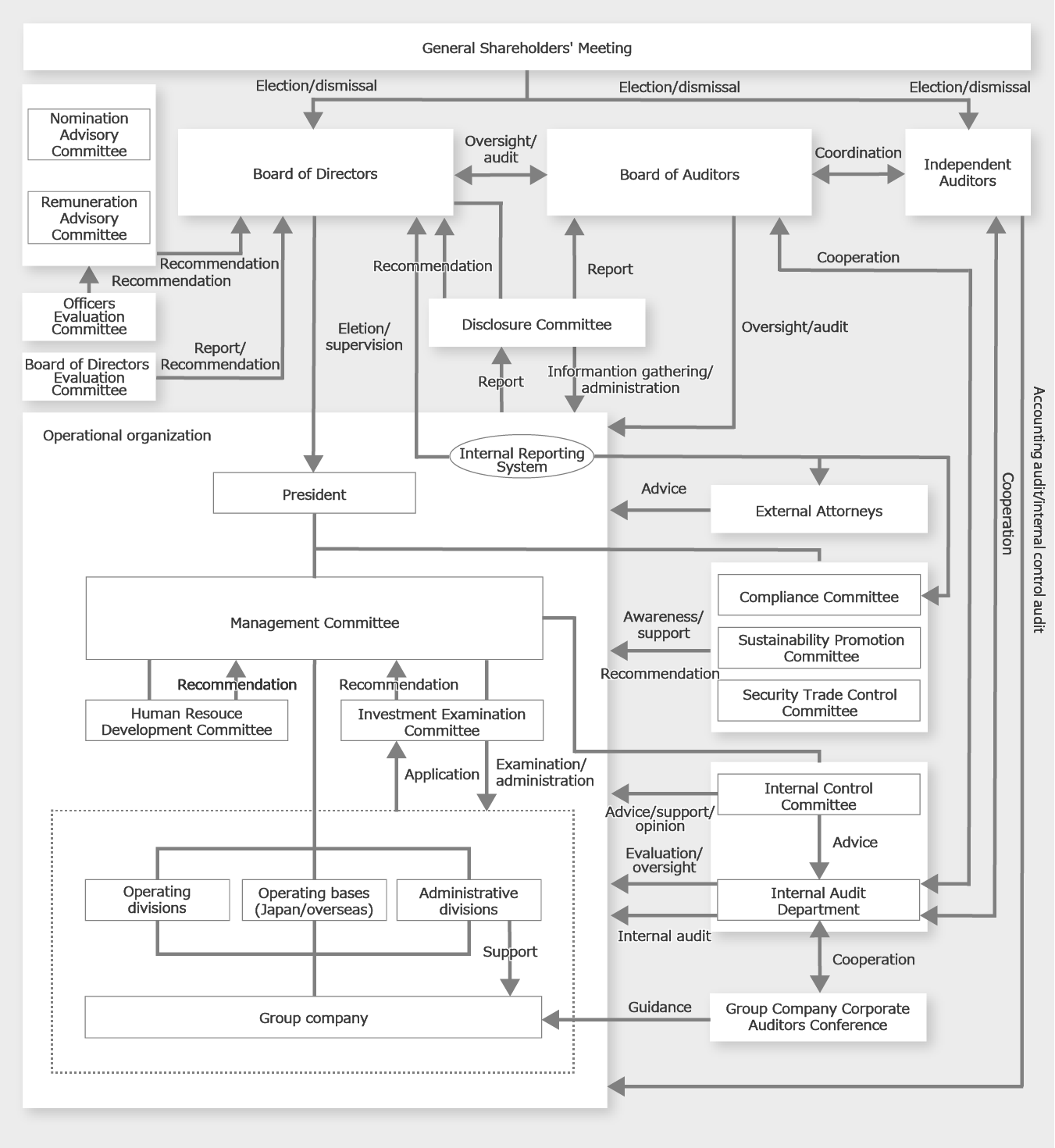

Corporate Governance Structure

We adopt the governance system of a company with an Audit and

Supervisory Committee. The Audit and Supervisory Committee

consists of four directors who are Audit and Supervisory

Committee members (three of whom are outside directors)

appointed at the General Shareholders Meeting.

Since April 2012, we have introduced an executive officer

system to establish a system that enables more detail-oriented

business operations and to promote quicker and more efficient

decision-making.

The Board of Directors has 14 directors

(seven of whom are outside directors) appointed by the General

Shareholders Meeting. It meets once a month, in principle, to

make decisions on matters stipulated by laws and regulations and

in the Articles of Incorporation, draft plans for important

management for the Group, and supervise business execution.

The Management Committee mainly consists of officers at

the level of managing executive officer or above and full-time

Audit and Supervisory Committee members. It meets twice a month,

in principle, to submit important issues related to the

management decisions of the Group to the Board of Directors as

agenda items, and to promptly execute business in accordance

with the management policy determined by the Board of Directors,

as the highest body for business execution.

Regarding

personnel matters and treatment for officers, the Company has

introduced a three-committee system that consists of the

Officers Evaluation Committee, Nomination Advisory Committee,

and Remuneration Advisory Committee, and the following

procedures have been adopted.

Regarding evaluations of

officers, we have introduced mechanisms whereby decisions are

made by the Officers Evaluation Committee, which is chaired by

the President and whose majority members consist of outside

directors. The committee will meet at least twice a year to

perform a comprehensive evaluation based on an assessment of the

level of commitment of executive directors (excluding the

Chairman, President, and outside directors) and a peer review

process by all directors and executive officers, and provide the

overall evaluation results to the Nomination Advisory Committee

and the Remuneration Advisory Committee.

Regarding the

appointment of officers, the Nomination Advisory Committee,

which is chaired by an outside director and whose majority

members consist of outside directors, will review the

composition of officers for the following fiscal year based on

the evaluation of officers and the results of performance

evaluations of employees. A draft will then be submitted to the

Board of Directors where a proposal of the list of candidates

will then be forwarded to the Ordinary General Shareholders

Meeting.

Regarding executive remuneration (excluding that

of directors who are Audit and Supervisory Committee members),

the Remuneration Advisory Committee, which is chaired by the

President and whose majority members consist of outside

directors, prepares a draft of the basic remuneration for the

next fiscal year, after reviews based on the results of officer

evaluation, and the Board of Directors makes the final decision.

In terms of executive bonuses, we use a system of

performance-linked salary for executive directors which

specifically reflects the achievements and responsibilities of

each executive. After the Remuneration Advisory Committee

reviews a draft of calculation rules for the performance-linked

salary for each fiscal year, the Board of Directors makes the

final decision. In addition, restricted stock remuneration for

executive directors is positioned as remuneration for the

responsibility that each management team has to shareholders for

enhancing corporate value. The Remuneration Advisory Committee

reviews the appropriate level for each position, and the

specific number of shares to be paid (the amount of monetary

compensation claims to be applied to pay the acquisition price

of the shares) is determined by the Board of Directors.

Regarding the evaluation of the effectiveness of the Board

of Directors, we have introduced a system in which the Board of

Directors Evaluation Committee, chaired by one of the outside

directors and composed of all outside directors, plays a central

role. The committee reports the results of its evaluation and

makes proposals for improvement to the Board of Directors.

Evaluation of the Effectiveness of the Board of Directors

Since FY2019, we have been analyzing and evaluating the effectiveness of its Board of Directors to further improve its functions. The summary and results of the effectiveness evaluation of the Board of Directors recently performed are disclosed as follows.

- Evaluation method

-

For FY2023, a third-party assessment was made to evaluate

the effectiveness of the Board of Directors in a neutral and

objective manner.

• An anonymous questionnaire survey of all directors and corporate auditors

• A third-party interview of all directors and corporate auditors

• Discussions at meetings of the Board of Directors Evaluation Committee

• Discussions at Board of Directors meetings - Questionnaire contents

-

• Questions about the ideals, composition and operation of

the Board of Directors

• Questions about discussions held at Board of Directors meetings

• Questions about the monitoring functions of the Board of Directors

• Questions about the performance and training of inside/outside directors

• Questions about dialogue with shareholders (investors) - Summary of evaluation result

-

It was confirmed that the Board of Directors appropriately

discusses factors and viewpoints that directors and

corporate auditors should emphasize in decision-making and

supervision concerning basic management policy, business

strategy and important business execution. And the Board of

Directors Evaluation Committee evaluated that the

effectiveness of the Board of Directors is ensured.

In addition, as an approach to the issues recognized in the previous effectiveness evaluation, improvements were made to the operation of the Board of Directors, such as setting time limits for explaining meeting materials and making the materials more concise.

On the other hand, several mid- to long-term issues were identified to further enhance effectiveness including the following: -

Mid- to Long-term Issues

• Strengthening the supervisory function of the Board of Directors, including delegating authority to the Management Committee and reviewing the organizational structure

• Examining the diversity needed on the Board of Directors

• Operating the Board of Directors in a way that further facilitates smooth discussions at its meetings

• Further enriching discussions at the Board of Directors on important matters such as mid- to long-term business strategies and succession planning

We will continue to strive to improve the effectiveness of the Board of Directors, strengthen its functions, and continuously improve corporate value.

- [The Corporate Governance Structures]

-

Internal Control Policy

Hanwa is committed to utilizing an effective corporate governance system to achieve sustained growth and other progress, while minimizing exposure to risks associated with achieving business objectives. To this end, we have established a fundamental policy regarding the development and implementation of an internal control system to ensure that business activities are conducted properly and efficiently.

Risk Management

We define "risk" as "uncertainty that may affect the achievement of the Company's business strategy and business objectives" in the Company's “Basic Policy on Risk Management”. And we implement specific measures to control various risks that may arise from business operations within our company group. It is basic concept of the risk management that we contribute to achieving dramatic business growth through proactive investments and business expansion with these measures.

- Risk Management Framework

-

We recognize the strategic importance of risk management as

a material issue, and we have established a framework under

the basic policy determined by the board of directors. We

have appointed the head of risk management within the

management section as the overall responsible person for

risk management. Additionally, we have implemented necessary

risk management structures and specific management methods.

Furthermore, we are actively promoting initiatives to

enhance the overall risk management awareness among top

management. To prevent the occurrence of risks and mitigate

those that do arise, we definitize the departments to

address each risk. Additionally, we develop various

regulations and response manuals.

Specifically, within the various risks surrounding our company—including credit risks (including credit risks related to creditworthiness and country risks), business investment risks, market risks (such as commodity price fluctuations), and compliance risks (including adherence to security trade management and various economic sanctions)—we identify significant risks that could significantly impact our company’s management. We establish a Risk Management Department as a specialized unit to manage these risks effectively. This department collaborates with relevant divisions to develop necessary policies and regulations, ensuring an integrated risk management system on a consolidated basis.

Among these significant risks, for those that can be quantitatively assessed, we calculate risk assets based on the maximum potential loss that could occur in the future on a consolidated basis. Regularly, we assess the overall risk exposure across the entire organization. With this information, we practice management that controls risks within the scope of shareholder capital (risk buffer). To achieve ambitious business growth through proactive investments and expansion, we strategically take risks within the risk buffer, aiming to enhance profitability while considering risk factors. Our goal is to balance improved corporate value with securing of soundness of the management.

UK Tax Strategy

The publication of this strategy statement is regarded as satisfying the duty under Paragraph 16(2),Schedule 19, Finance Act 2016 in UK.